Cancelling Car Insurance Early: What It Really Costs, When It Makes Sense, and How to Do It Right

|

Getting your Trinity Audio player ready...

|

Cancelling Car Insurance Early: What It Really Costs, When It Makes Sense, and How to Do It Right

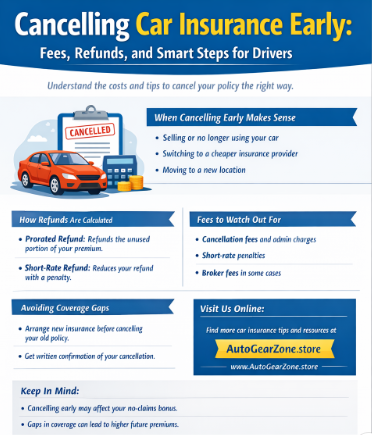

Cancelling car insurance early is something many drivers consider, but few fully understand. Life changes fast. You might sell your car, switch to a better policy, move to another country, or simply stop driving. In these situations, keeping a policy you no longer need feels wasteful. Still, cancelling car insurance early can come with fees, refund adjustments, and unexpected consequences if it’s done without planning.

This topic matters because car insurance is a legal and financial responsibility. Making the wrong move can cost more than staying insured. This guide explains how early cancellation works, when it’s reasonable, and how to handle it properly so you protect your money, coverage history, and peace of mind.

Key Takeaways at a Glance

- Cancelling early may lead to prorated or short-rate refunds

- Fees depend on timing, insurer rules, and location

- Cooling-off periods usually allow penalty-free cancellation

- Gaps in coverage can increase future premiums

- Switching insurers is often smarter than cancelling outright

Free PDF download : Cancelling Car Insurance Early: Smart Tips for Drivers

This concise guide explains how to cancel car insurance early, including when it makes sense, how refunds are calculated, and what fees to expect. Learn practical tips to avoid coverage gaps, protect your no-claims bonus, and make informed insurance decisions with ease.

What Cancelling Car Insurance Early Actually Means

Cancelling car insurance early means ending your policy before its scheduled expiration date. Most car insurance policies are written for a fixed term, often six or twelve months. When you cancel mid-term, the insurer recalculates what you owe or what they owe you based on how long the policy was active.

This process is different from simply letting a policy expire. Early cancellation may trigger administrative charges or reduced refunds. Understanding this distinction helps you avoid surprises and ensures you know what you’re agreeing to before you make the call.

Common Reasons People Cancel Car Insurance Early

Selling or Getting Rid of a Vehicle

When you sell your car or it’s written off, there’s usually no reason to keep the insurance active. Cancelling car insurance early in this situation often makes sense, especially if you no longer own another vehicle.

Switching to a Better Policy

Drivers frequently cancel early to move to a cheaper or more suitable insurer. While switching is common, timing matters to avoid overlapping payments or coverage gaps.

Moving or Lifestyle Changes

Relocating abroad, working remotely, or driving far less can all lead people to reconsider their coverage needs and cancel an existing policy.

How Car Insurance Refunds Work When You Cancel Early

Refunds depend on how your insurer calculates unused coverage. A prorated refund returns the unused portion of your premium minus small administrative costs. A short-rate refund reduces that amount further as a penalty for cancelling early.

For example, if you prepaid your premium and cancel halfway through, you might expect half back. Instead, fees and short-rate adjustments could reduce your refund significantly. In some cases, a driver cancelling car insurance early might receive $160 less than expected due to these deductions.

Early Cancellation Fees You Should Expect

Many insurers charge an administrative fee for early termination. This fee covers processing, documentation, and system updates. While it may seem small, it can noticeably reduce your refund.

Some policies include short-rate penalties, especially when cancellation happens after the cooling-off period. Broker-arranged policies may add extra charges, which is why reviewing the policy wording before cancelling is essential.

Cooling-Off Period vs Cancelling Later

Most insurers offer a cooling-off period at the beginning of a policy. During this time, you can usually cancel with minimal or no penalties, provided no claims were made.

Once this window passes, cancelling car insurance early becomes more expensive. That’s why acting quickly after realizing a policy isn’t right can save money and stress.

Does Cancelling Early Affect Your No-Claims Bonus?

In many cases, cancelling a policy does not erase earned no-claims time, but it may delay future benefits. If the policy hasn’t completed a full term, the insurer may not issue proof of earned discount.

This matters when switching providers. Always request documentation showing your claims history to ensure your discount transfers correctly.

Risks of Cancelling Car Insurance Too Soon

The biggest risk is a coverage gap. Even short uninsured periods can raise red flags with insurers and lead to higher premiums later.

There are also legal risks in many regions if your vehicle remains registered but uninsured. Cancelling car insurance early should always be coordinated with your vehicle status and local regulations.

How to Cancel Car Insurance the Right Way

Start by reviewing your policy terms carefully. Check for fees, notice requirements, and refund rules. Next, arrange replacement coverage if you plan to keep driving.

Contact your insurer directly, follow their cancellation process, and request written confirmation. Track your refund timeline and monitor your bank statements to ensure accuracy.

Cancelling vs Switching Car Insurance Providers

Switching insurers is often more practical than cancelling outright. When done correctly, switching avoids coverage gaps and may reduce fees.

Time your new policy to start the same day the old one ends. This approach maintains continuous coverage and protects your insurance history.

Quick Tip: Always arrange new coverage before cancelling an active policy.

Early Cancellation vs Natural Policy Expiry

| Situation | Cost Impact | Refund | Risk Level | Best Action |

|---|---|---|---|---|

| Cancel mid-term | Fees apply | Partial | Medium | Review terms |

| Cooling-off cancellation | Minimal | Near full | Low | Act early |

| Switch insurers | Low | Balanced | Low | Overlap carefully |

| Let policy expire | None | None | Lowest | Plan ahead |

Common Questions Drivers Ask

Can I cancel car insurance early at any time?

Yes, but fees and refund rules depend on your policy terms.

How long does a refund take?

Most insurers process refunds within a few weeks, though timelines vary.

Is switching better than cancelling?

Often yes, because it avoids gaps and preserves coverage history.

Will insurers know I cancelled early?

Your coverage history may show a shortened policy period.

Expert Tip: Request written confirmation of cancellation to avoid billing disputes.

Frequently Asked Questions

Is cancelling car insurance early bad for my record?

Not usually, as long as you maintain continuous coverage.

Do I need proof to cancel?

Some insurers may request proof of sale or new insurance.

Can I cancel online?

Many insurers allow online cancellation, but confirmation is essential.

A Clear Way Forward

Cancelling car insurance early is neither good nor bad on its own. It’s a financial decision that depends on timing, policy terms, and your next steps. When handled thoughtfully, early cancellation can save money and simplify your coverage. When rushed, it can lead to fees, higher premiums, and unnecessary stress.

The smartest approach is to understand your policy, plan your transition carefully, and keep coverage continuous whenever possible. That way, you stay protected while making choices that truly fit your current situation.